Financial planning is rarely straightforward, and when family expectations collide with personal values, the decisions become even more complicated. In this case, a man’s $1M life insurance policy has ignited a debate over priorities, duty, and fairness.

With a new child on the way, his wife insists that the entire sum should be allocated solely for their family’s future. To her, financial security for their children must take precedence. However, the man feels a deep responsibility beyond his household—his desire to offer a modest portion of the policy to his sister, who is struggling financially.

This dilemma raises thought-provoking questions: Should financial resources stay strictly within the nuclear family, or does moral responsibility extend beyond? While his wife views any deviation as a risk to their children’s well-being, he sees an opportunity to significantly impact his sister’s life.

Ultimately, this debate reflects a broader conversation about personal responsibility, familial obligations, and the complex nature of planning for the unknown. As the couple navigates this decision, the challenge is finding a balance that honors both immediate family security and the human impulse to help those in need.

‘AITA Wife wants 100% in case of untimely end?’

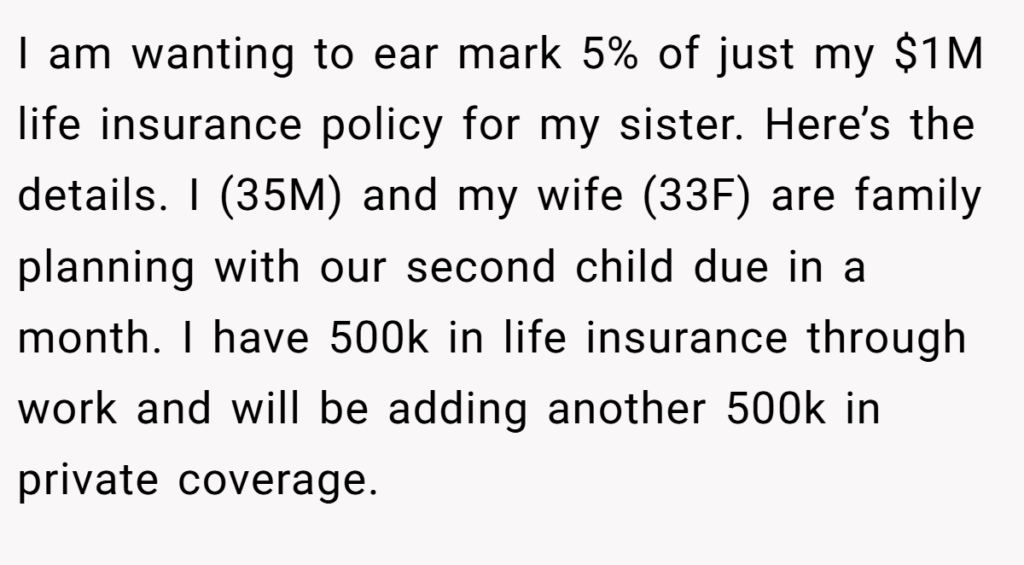

Navigating the distribution of life insurance benefits is rarely a straightforward process. For one man, the decision over his $1M policy has sparked a debate between safeguarding his immediate family’s future and offering financial help to his struggling sister.

Traditionally, life insurance serves as a financial safety net for those dependent on the policyholder’s income. However, personal values and familial expectations can complicate this simple principle. In this case, the man’s wife insists that every dollar of the policy should be reserved for their children, ensuring long-term security. Meanwhile, he believes that allocating just 5%—or $50K—toward helping his sister with a home down payment could significantly improve her financial outlook.

This conflict highlights a broader question: Should financial resources be strictly designated for immediate family needs, or is there room to support extended family members in difficult circumstances?

Personal finance expert Suze Orman stresses the importance of prioritizing dependents, stating, “Life insurance should be designed primarily to protect those who rely on you financially, ensuring they have the resources to navigate a difficult transition.” This traditional viewpoint suggests that primary beneficiaries should be those most impacted by the loss of income.

However, the discussion doesn’t end there. The unpredictable nature of life adds another layer to this decision—while the probability of an untimely death may be low, the financial consequences for loved ones can be severe. His proposal to set aside a small fraction for his sister reflects an attempt to balance responsibility with compassion, though his wife remains wary of the risks.

Ultimately, the dilemma raises critical questions about financial priorities. Is it reasonable to extend support beyond the immediate household, or should family security take precedence above all else? Those facing similar choices might explore alternative financial solutions, such as separate policies or trusts, to strike a balance between helping relatives and preserving core family stability.

Clear communication, strategic planning, and expert guidance are essential in ensuring that financial decisions support all parties involved—without compromising those who depend on them the most.