In the intricate weave of life, where love and commitment thread through every moment, financial security stands as a silent but essential pillar. For one woman, merging her future with the man she cherished felt like a natural step—a heartfelt promise to safeguard him against the uncertainties that she had once faced alone after losing her parents.

But the foundation she carefully built has begun to crack, all triggered by a simple yet deeply significant request regarding a life insurance beneficiary. What began as an act of love—an assurance that he would always be protected—has now unraveled into a harsh reality, forcing her to question the strength of their partnership and their shared preparedness for the unknown.

As his unwavering refusal settles in, the seamless rhythm of their relationship falters, replaced by an unsettling imbalance that casts doubt over their financial and emotional ties. The unspoken tension hums beneath the surface, revealing vulnerabilities that threaten the stability of even the most devoted unions.

‘AITAH for canceling my life insurance policy because my husband wont make a beneficiary on his?’

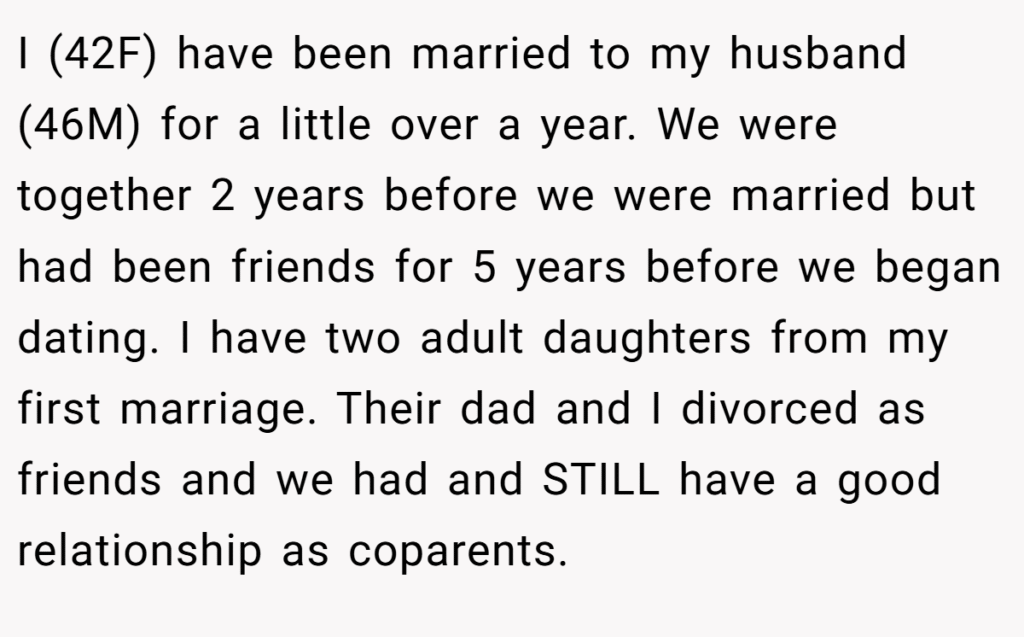

Introducing a partner to family and integrating finances often mark deeper levels of commitment in a relationship. Ensuring mutual financial security through life insurance is a practical extension of this bond, reflecting long-term planning and shared responsibility. In this case, the wife’s proactive approach to safeguarding both her children’s and her husband’s future demonstrates thoughtfulness and foresight.

However, her husband’s unwillingness to reciprocate raises critical questions about his perspective on partnership. His decision to maintain his financially stable and geographically distant mother as his sole beneficiary—despite his wife extending the same security to him—suggests a prioritization of familial ties over the practical needs of their marriage.

This choice can be viewed in multiple ways—whether as an emotional attachment outweighing rational financial planning or, as some Reddit commenters speculate, a sign of hesitancy in fully investing in the marriage. Dr. Gail Saltz, clinical associate professor of psychiatry at New York Presbyterian Hospital, underscores the significance of financial decisions in relationships, stating, “Money issues are one of the top stressors in a marriage, and disagreements about finances often reflect deeper, unresolved conflicts about values, control, and security.”

The wife’s response—canceling her policy for him and redirecting her assets toward her children—stems from feeling unprotected and unrecognized in their financial union. Having already navigated the complex process of managing her late parents’ affairs, she is particularly mindful of shielding her children from similar burdens while securing her own future.

This scenario underscores the importance of honest and open discussions about financial expectations early in a marriage. The apparent disconnect in how each partner views financial obligations highlights potential cracks in their foundation. While financial independence is crucial, failing to consider a spouse’s security—especially when one partner has already demonstrated commitment—can erode trust and breed tension.

Ultimately, addressing these deeper concerns through transparent communication or professional financial counseling may help bridge this divide, paving the way for a more balanced and secure future for both partners.